April 21, 2020

A number of New England securities regulators have issued orders or guidance modifying key provisions of their regulations in light of the COVID-19 pandemic. New England securities regulators, in particular, have provided tailored relief to financial professionals with respect to certain filing deadlines and regulatory requirements. A careful reading of the guidance issued by these regulators also suggests that financial professionals may likely see longer term changes, as well as a continued and retrenched focus on stopping fraud affecting retail investors. This alert provides an overview and comparison of key aspects of the orders and guidance issued in Massachusetts, Vermont, New Hampshire, Maine, and Connecticut, as well as a brief analysis of the language of the guidance and public comments to offer further insight regarding likely regulatory changes prompted by the COVID-19 pandemic.

A. New England Securities Regulators Issue Orders and Guidance Modifying Key Regulatory Requirements; The SEC Moves Forward With Reg BI

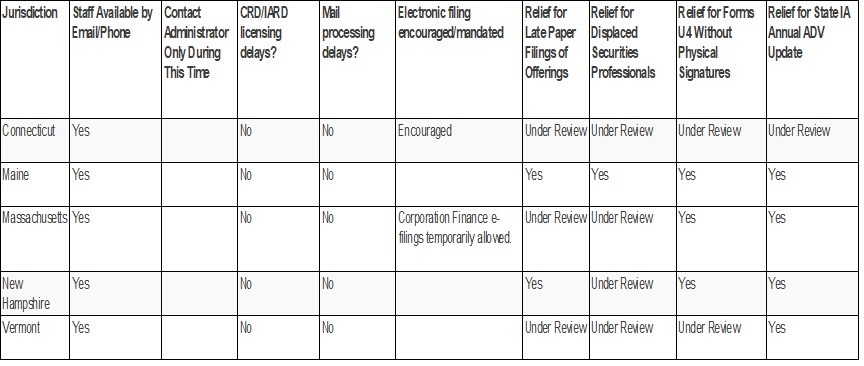

Massachusetts, Connecticut, Vermont, New Hampshire and Maine have all issued orders and guidance addressing COVID-19.

To summarize:

In addition to the state action, there has been some activity at the Federal level as well. At the Federal level, SEC Chair Jay Clayton recently announced that the implementation of Regulation Best Interest (“Reg BI”) will go forward as planned on June 30, 2020. Reg BI establishes a new standard of conduct for broker-dealers and their associated persons when making a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer, to ensure that the customers’ interests are always put ahead of the interests of their advisors. In connection with Reg BI, SEC-registered investment advisors and broker-dealers will be required to file Form CRS, a brief customer or client relationship summary that provides information about the firm. In a statement on April 2, 2020, Chairman Clayton noted that in these difficult times, nothing is more important than having customers’ interests come first, and as a result indicated that firms should continue to make good faith efforts around operational matters to ensure compliance by June 30, 2020, including devoting resources as necessary and available in light of the circumstances. Chairman Clayton further stated, “[t]o the extent that a firm is unable to make certain filings or meet other requirements because of disruptions caused by COVID-19, including as a result of efforts to comply with national, state or local health and safety directives and guidance, the firm should engage with us. We expect that the Commission and the staff will take the firm-specific effects of such unforeseen circumstances (and related operational constraints and resource needs) into account in our examination and enforcement efforts.”

1. Massachusetts Response Includes Extending Filing Deadlines

On March 24, 2020, Secretary Galvin issued an Emergency Order, effective through April 30, 2020 (and subject to possible extension) impacting certain filing deadlines and regulatory changes in light of COVID-19. The Executive Order particularly granted authority to the Massachusetts Securities Division (the “MSD”) to relax corporation finance filing requirements and registration requirements. In response, the MSD issued a Notice providing for: (1) the waiver of manual signature and notarization requirements; (2) the wavier of signature requirements on Form U4 for new registrations; (3) modification of CORI Form requirements as applicable to new IAR registrations; and (4) extension of ADV filing requirements for up to 45 days.

As a result, the MSD temporarily modified Section 202 of the Massachusetts Securities Act, as well as regulations found at 950 Code Mass. Reg. 12.205 concerning registration requirements, and relaxed, for example 14.402 private offering “wet” signature requirements. In comparison to other New England states, the MSD has limited relief to certain “nuts and bolts” filing requirements. While encouraging open lines of communications, the MSD chose not to provide further regulatory relief, for example concerning potentially displaced advisors, such as Maine and New Hampshire (as discussed below).

2. Maine Issues Broad Order For Those Financial Professionals Affected By COVID-19

On March 25, 2020, the Maine Office of Securities issued Order No. 2020-11 (the “Maine Order”), effective until May 1, 2020. The Maine Order, similar to the relief provided by the MSD, provides in part for the extension of ADV filing requirements for up to 45 days and relaxing of certain filing requirements. Notably, the Maine Order:

• Broadly relaxes paper filing requirements for issuers, broker-dealers and investment advisors;

• Provides a waiver for late filing fees for notice filings;

• Provides a waiver of Chapter 504 §6(5) and 515 §10(2) training requirements (relative to in-person training requirements); and

• Suspends on-site examinations of BD branches pursuant to Chapter 505§ 7(4)(B).

Interestingly, the Maine Order also sets forth a temporary exemption for non-Maine licensed investment advisors to operate in Maine without formally registering. Such relief, of course comes with strings. In particular, the investment advisor must notify the Office of its operation, be registered and in good standing with all required regulators, not be subject to any enforcement

proceedings, is prohibited from soliciting new clients in or from Maine, and must only provide services to those existing clients as of March 1, 2020.

Moreover, the Maine Order removes nearly all of the procedural restrictions concerning transferring of client accounts to another advisor as a result of “current or potential effects of the coronavirus pandemic.” Despite the relief provided by such an Order, an investment advisor would be wise to review its contract with clients before undertaking such steps.

3. Connecticut Issues Interim Guidance Encouraging Paperless Submissions

Connecticut’s Department of Banking (the “Department”) issued interim guidance on March 25, 2020, which was updated by the Department on April 9, 2020. Such guidance is similar to the relief provided by the MSD and does not have as broad a scope as the Maine Order. As an accommodation to securities registration, exemption, and covered security filers (including business opportunity registration filers), the Department has enabled electronic filing and payment – including private offerings made pursuant to Regulation D. The Department notes this accommodation will continue “for the foreseeable future”, which will be reassessed once normal functions resume. Notably, the Department has also waived manual signature requirements and has temporarily suspended notarization requirements.

4. New Hampshire Issues Similar Orders For Financial Professionals Affected By COVID-19

On April 9, 2020, New Hampshire’s Bureau of Securities Regulation (the “NH Bureau”) issued an emergency order covering financial professionals. The NH Bureau order offers a blended approach which includes many key filing relief accommodations found in the Massachusetts and Connecticut orders. In particular, the order relaxes new registrant Form U4 signature requirements as similarly contained in the Massachusetts Order, and consistent with Massachusetts and Maine, provides relief from annual ADV filings and from document delivery requirements under the NH Securities Act. Moreover, the NH Bureau has implemented a limited “displaced” advisor registration exemption (otherwise subject to R.S.A. 421-B) similar in scope to the Maine Order.

5. Vermont Guidance Limited to ADV Extension

Current guidance from the Vermont Securities Division is limited in comparison to the other New England States. At this point, in addition to issuing general guidance concerning COVID-19 precautions, Vermont has extended the deadline for firms to file their annual Form ADV amendment until April 30, 2020.

B. Short Term Changes By State Regulators Could Lead to Longer Term Regulatory Oversight Changes, Yet Continued Focus On Fraud Will Remain

The most immediate impact likely to come from the adoption of these emergency orders and guidance is a modification of examinations of investment advisors and broker-dealer firms. While many states have in the past conducted remote examinations, the COVID-19 crisis will likely lead to increased numbers of desk examinations moving forward. Desk examinations are not completely new in the regulator’s repertoire; however, they were previously disfavored in comparison to “onsite” examinations. The MSD, for example, conducted desk examinations in response to regulatory changes brought on by Dodd-Frank’s impact on SEC registration thresholds, which resulted in a significant and immediate increase in new investment advisors and investment advisor representatives subject to its oversight. New Hampshire for its part has directly provided in guidance accompanying its order that, “[f]ield examiners are conducting streamlined, desk examinations using phone and email correspondence in lieu of traditional on-site examinations during this time.” Again, as a result of COVID-19, we expect that remote examinations will become a regular fixture of the various states’ examination programs. Investment advisors and broker-dealers subject to desk inspections should take steps to ensure that they have adequate systems and resources in place so that documents and other files requested by the examining authority can be accessed electronically rather than in person.

On a more macro level, the COVID-19 pandemic likely will prompt aggressive enforcement of state antifraud provisions and increased litigation and regulatory actions. Comments by the Maryland Securities Commissioner, at the Financial Stability Oversight Council, on behalf of the North American Securities Administrators Association (“NASAA”) indicate that in addition to accommodations regarding registration, filing and form delivery requirements, “[state and provincial regulators will] remain focused on our mission to protect investors from opportunistic frauds. [State and provincial regulators] are diligently monitoring for fraudulent activities, especially those that arise when the unscrupulous work to monetize fear. Both individual states and NASAA have issued advisories to investors to be on alert for persons soliciting investments in companies offering such things as testing breakthroughs and miracle cures.” Maine’s administrator, Judith Shaw, also signaled the need for balance, commenting, “[t]he impact the coronavirus pandemic is having on the country and our state is far reaching and includes our financial professionals, in an effort to ensure financial professionals can continue to work and that investors continue to receive the level of service they expect and deserve from those professionals, I have issued an Order providing temporary relief from some regulatory requirements.” Thus, fraud, including fraud perpetrated through technical violations, will likely be an enhanced focus of securities regulators for the foreseeable future. In practice this may materialize in states charging financial professionals with fraud as an accompaniment to lesser “dishonest and unethical” counts.

C. Conclusion

Each New England state has issued orders or guidance addressing continued, yet modified, operations for financial service professionals. Financial firms registered in any one of these jurisdictions (or operating subject to one of the aforementioned exemptions), should take note of the modifications and pay particular attention to the time periods during which relief is permitted. Further, in line with our prior guidance concerning business development plans, it is worthwhile for registrants to review potential registration issues if the contingent operating location is in another state. Additionally, while many of the states have expressed a willingness to participate in an ad hoc dialogue with the industry to address issues that may arise as a result of the COVID-19 pandemic, financial professionals should not be lax in respecting the regulatory power of the states. Regulators have been clear that there will be a continued emphasis on stopping fraud in all of its forms, and it is expected that regulators will cast a wider than usual net to investigate and charge entities and individuals directly or indirectly associated with such schemes.

We hope that you find this summary helpful. We will endeavor to update the situation as the state and federal regulators issue additional guidance. Stay safe and stay tuned for further developments.

![]() securities_covid19_orders_and_regulatory_guidance_impacting_financial_professionals_in_the_new_england_region.pdf

securities_covid19_orders_and_regulatory_guidance_impacting_financial_professionals_in_the_new_england_region.pdf